Dear Partner,

Years ago, my good friend Howard asked if I’d bring barbecued ribs to a small dinner party he was hosting. After I agreed, he told me the guest of honor was a renowned, but retired, food critic for the Los Angeles Times. Suddenly nervous, I decided to try and up my game. Instead of southern-style baby back ribs, which I’d perfected and served many times before, I decided to go with a new recipe – an Asian-inspired, smoky, sweet and spicy rib that I served with vintage champagne. What I served wasn’t what Howard was expecting, but more than a decade later, he’s still talking about that delicious pairing. Surprises can be good or bad — this was a good one!

I’ve been thinking about surprises a lot lately given all that has transpired in recent months, including President Biden ending his reelection campaign and assassins targeting former President Trump.

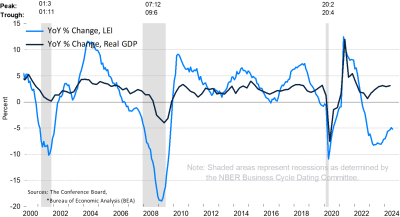

From a macroeconomic perspective, I’ve been most surprised by the resilience of the U.S. economy despite aggressively restrictive monetary policy. Historically reliable indicators suggested that we’d find ourselves in a far more challenging environment than we are in today. The Leading Economic Indicators (see below) have signaled a recession for many months now, yet the economy and corporate earnings have continued to grow at surprisingly robust rates; the latest estimates suggest 10-11% earnings growth for the S&P 500 in 2024 followed by another 15% in 2025. Expectations for strong earnings growth and a belief that recession will be avoided have combined to produce a whopping 36% total return for the S&P 500 over the last 12 months.

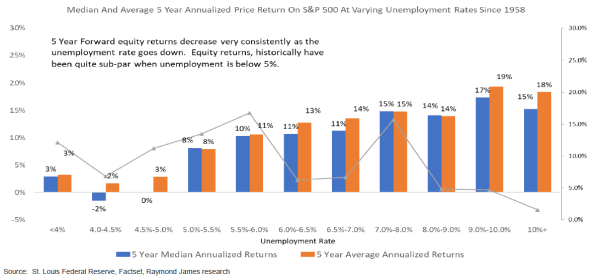

In the past (see chart below), the stock market has produced mediocre returns after the economy has reached full employment – e.g., an unemployment rate of 5% or less. Basically, when the job market (and thus the economy) looks about as good as it can get, future stock market returns are often disappointing. Unemployment has been below 5% for three years now, yet the S&P has powered ahead at roughly 10% a year anyway.

Given my three decades of investing experience and my appreciation for economic history, I came into the year with a defensive mindset. While data supportive of an economic “soft landing” has been a pleasant surprise, it has powered a roaring bull market that we simply haven’t been able to keep up with. It has been particularly tough for Value Investors: roughly 30% of stocks in the Russell 1000 Value are in negative territory this year. Our portfolio has not been immune to these pressures.

Despite the seemingly glowing headlines, economic prosperity has not been universal. Some industries (commercial real estate, trucking, chemicals, agriculture, and industrial and automotive semiconductors, for example) are currently facing recession-like conditions. In addition, while consumer spending has remained strong for the high-income cohort, low wage earners are cutting back. This is creating a wide dispersion in the short-term performance of stocks: while the S&P 500 has returned more than 22% this year, roughly 20% of the stocks in the index are down.

Portfolio Changes

While I remain concerned about the optimism baked into stock indices like the S&P 500, at Poplar Forest, we are continuing to find what we believe are compelling long-term opportunities. During the last quarter, we made new investments in Global Payments and LPL Financial while liquidating American International Group (“AIG”), Stifel Financial and Warner Discovery. Warner Discovery delivered more cost savings from their 2022 merger than promised, but the underlying pressure in the media business has overwhelmed those gains. And while AIG and Stifel appear to offer attractive future returns, those prospective returns were dwarfed by the potential we see in Global Payments and LPL Financial.

Global Payments is a provider of payment technology that allows businesses to accept credit and debit card payments for the products and services they sell. The stock’s Price-to-Earnings (“P/E”) multiple collapsed from 25x in 2021 to less than 9x today. Investors who once believed this was a quality growth company now believe that new competitors will eat the company’s lunch. While we did not believe the prior hype surrounding the company was warranted, we think the competitive concerns reflected in the current stock price are exaggerated. If the company can meet our expectations for at least 10% annual EPS growth, the P/E ratio would only need to expand to 12x for the stock to enjoy strong returns.

LPL Financial is a fast-growing wealth management platform. Since 2019, it has grown advisory and brokerage assets at a 16% annual rate through organic growth and acquisitions. The company’s product set has allowed it to take share from competitors, particularly wirehouses, as advisors seek the benefits of becoming independent on LPL’s platform. Recently, LPL shares sold-off on concerns that regulators are questioning yields on advisory sweep cash being paid to clients given the broker’s fiduciary duty. Wells Fargo, Morgan Stanley, and Bank of America all selectively increased the yields they offered after regulator inquiries on high cash balance accounts. Spreads on client cash are an important source of profits for brokers. We believe this issue has created a rare opportunity to own a best-in-class franchise at a large discount to its intrinsic value. If LPL can deliver the $29 of earnings per share that we expect and trade at its historic valuation of 15x, the stock could appreciate to $435 – more than double the current price.

For decades now, index funds and their kin have taken an ever-larger share of investors’ portfolios. To me, that is akin to going to a restaurant and ordering a little bit of everything on the menu. I like having the choice between ribs, brisket and pulled pork. And I want to pick my own side dishes and dessert. In the same way, we think it is important to carefully choose the securities, like Global Payments and LPL Financial, that go into our portfolios.

Elevated Uncertainty Ahead

With investors partying like its 1999, I feel like a guy bringing broccoli to the barbecue. The consensus opinion currently reflected in stock prices seems to be that the economy is on track to achieve an historically rare “Soft Landing.” Inflation is coming down, the Fed has started cutting interest rates, and unemployment, while up a bit, is still low. As long as people have jobs, consumer spending will remain sufficiently resilient to keep the economy growing at a reasonable clip — or so the prevailing narrative goes.

While current data is supportive of that soft-landing narrative, investors seem to be on edge – in other words, the consensus is fragile. Consumers appear increasingly strained and value conscious. Credit card and auto loan delinquencies have increased to worrisome levels. Nervous bulls are watching incoming jobs data for any signs of weakness. In early August, a weak employment report triggered a quick 8.5% decline in the S&P with six of the Magnificent 7 leading tech stocks falling almost twice as much as the S&P 500. The S&P 500 recovered almost all of its losses in the next two weeks, though it is notable that the Magnificent 7 didn’t. It feels to me like many investors are playing a game of chicken – they seem to believe that they will be able to quickly unwind their riskier bets at the first whiff of a serious economic slowdown. But I worry about what will happen if a mass of investors try to flee the party at the same time. It could get ugly.

With stock prices at all-time high levels and the economy near full employment, the Fed cut short-term interest rates by 0.5% in mid-September and stocks rallied strongly. The Fed seems to have convinced the majority of equity investors that it can prevent a recession by cutting short-term interest rates. For an institution with such a poor forecasting track record (remember “transitory” inflation?), I continue to be amazed by how much credit investors give the Federal Reserve.

Recognizing that a cautious mindset is decidedly out of favor these days, I still think it is too early to declare victory over both recession and inflation. Core inflation is still closer to 3% than it is to the Fed’s 2% goal. With China announcing a large stimulus program in recent days, global economic growth may accelerate; commodity prices and 10-year Treasury yields have been picking up in response. On the growth front, anecdotes we are hearing from the management of companies that we talk to regularly suggest a weakening economy. Monetary policy is said to work with long and variable lags and this first 50 bps cut by the Fed still leaves policy in a restrictive state – in effect, while the Fed is letting up a little, it still has its foot on the brakes. On this front, we will continue to closely watch the unemployment picture for warning signs – so far the numbers are good, but they can deteriorate quickly. When talking to companies, we’ll also be on the lookout for positive developments, so called “green shoots,” that may suggest it’s time for a more offensive mindset.

The presidential election is another area of uncertainty given the divisive state of the race and the divergent policies articulated by both sides. Are tax rates going up or down? Are draconian tariffs coming? Mass deportations? Will the U.S. ever have to face consequences for massive deficit spending? I see lots of pressures on the economy if either of the candidates actually implements the policies they are advocating on the stump. Investors seem to expect a sufficiently divided government, meaning that the extreme proposals being discussed won’t actually get implemented, but what if the election brings either a surprise Blue or Red wave? We will be monitoring election polling – so far the poll numbers are supportive of the divided government narrative. We’ll know more in a few short weeks.

Geopolitical risk, particularly in the Middle East, continues to be worrying. If things degrade into a direct conflict between Israel and Iran, oil prices could spike in a destabilizing way in addition to the U.S. potentially being drawn into the conflict. The risk of escalation in Ukraine seems manageable as does our cold war with China, but the world appears to be on the precipice of major conflict on multiple fronts. The situation would normally drive a risk premium in markets (lower valuations), but the market narrative right now seems to be one in which the Fed will always save the day, regardless of the issue.

I’ll be the first to acknowledge that my macroeconomic crystal ball is no better than anyone else’s, and with the knowledge that negative surprises can hinder investment returns, I’ve long focused on identifying stocks that appear to offer a “margin of safety.” As famed Value investor Seth Klarman put it:

“A margin of safety is achieved when securities are purchased at prices sufficiently below underlying value to allow for human error, bad luck, or extreme volatility in a complex, unpredictable and rapidly changing world.”

With broad market measures, like the S&P 500, at an all-time high price and trading at a P/E multiple of nearly 24x consensus earnings for 2024, there appears to be little margin of safety in stocks today, but that is largely a function of the largest market cap companies which dominate the indices. By other measures, stocks look less extended. The median P/E for the 1700 stocks covered by Value Line, an investment research service, is currently between around 18x – in line with its median valuation over the last 25 years.

Despite frothy valuations for many of the largest companies, we continue to find those rare stocks with what we believe are outstanding prospects and that also offer a high margin of safety – a perfect pairing, much like those spicy Asian ribs I served with vintage champagne years ago. As you can tell from my earlier comments on our newest investments, we are still finding situations in which we believe we have a good chance of doubling our money over the next three years. At a time when the S&P 500 may struggle to achieve mid-single-digit returns, the opportunities we are pursuing look incredibly compelling on both an absolute and relative basis. And with our portfolio trading at little more than 13x earnings, I believe there is a substantial margin of safety in the carefully selected stocks we own today. While we hope for positive surprises, we believe that we are well positioned for a world that may ultimately look less rosy than it appears today.

Sincerely,

September 30, 2024

Click here for Standardized Performance and Top Ten Holdings: Partners Fund, Cornerstone Fund

Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling 877-522-8860.

Opinions expressed are subject to change at any time, are not guaranteed and should not be considered investment advice. Holdings and allocations are subject to change at any time and should not be considered a recommendation to buy or sell any security. Index performance is not indicative of a fund’s performance. Value stocks typically are less volatile than growth stocks; however, value stocks have a lower expected growth rate in earnings and sales.