Music has been important to me for as long as I can remember. I don’t have the talent for performance that my grandfather had, but listening to music has always made my good days better and my bad days a little easier to bear. For me, lyrics are key. I love heartfelt storytelling through song and seek it out across genres from Rock to Blues to Soul to Country to Bluegrass – songs about heartbreak and loss; too little money and too much liquor; cheating hearts and the repercussions of bad decisions.

One particularly bad decision recently turned the stock market on its head: Silicon Valley Bank’s (“SVB”) decision to hold a portfolio of long-term bonds while the U.S. Federal Reserve (the “Fed”) was aggressively raising interest rates. As everyone knows, that decision led to a run on the bank and SVB’s seizure by the FDIC in March. In the face of bank failures and forced mergers, investors fled financial service stocks of all types while seeking safety in the largest technology companies; in the short-term, the market zigged while our portfolio zagged. During this tumult, I have taken comfort in blues-laden songs about those who have it harder than I do – specifically, the songs of a Bluegrass musician named Billy Strings.

For those of you who aren’t familiar with his story, William Lee Apostol was born in 1992 in Lansing, Michigan. Two years later, his father died of a heroin overdose. His mother then married an amateur bluegrass musician who taught the four-year-old Billy to play guitar. Family life was challenging – so challenging that Billy left home at 13. Suffice it to say, Billy knows firsthand about the blues. What’s more, he’s a virtuoso on virtually any instrument with a neck and strings. He got the nickname Billy Strings from an aunt who was impressed that he had not only mastered guitar at a young age, but also the banjo and mandolin. He quit drinking seven years ago and that’s when his career really took off. He has won numerous awards including a Grammy for his 2019 album Home. His most recent album – Me / And / Dad – reunites Billy with his stepfather for a collection of covers of traditional bluegrass and country tunes from the likes of Doc Watson and George Jones. Despite the riches he might make if he transitioned to more popular country music, Billy Strings has stayed true to the bluegrass roots that were first planted by his stepfather in 1996 – the same year I first became a portfolio manager.

Like Billy, I have devoted my life to my craft. For almost 27 years, I have stayed true to an investment process that I believe makes as much sense today as it did when I first implemented it. I continue to believe that a focus on unloved and out-of-favor companies and industries can produce market-beating long-term returns. At times, investors may act like drunks in a bar – making decisions that seem smart in the moment, but that they regret in the morning. At Poplar Forest, we’re more sober-minded, and we don’t simply consider current circumstances, we also look forward to normalized conditions three to five years in the future. With our portfolio trading at less than 11x this year’s expected earnings, for companies that we believe can grow earnings faster than the market over the next few years, I can’t help but be excited by what I see.

Much More than a Call on the Value Cycle

“Well there’s nothing worse than feeling like you’re first in line for losing”

Billy Strings, This Old World, from his 2021 album Renewal

For the handful of years that investors were madly in love with FAANG stocks (Facebook, Apple, Amazon, Netflix, Google) and their kin, staying true to a value investing discipline felt like being first in line for losing. During those challenging years, many of my letters discussed a coming “Value cycle.” That forecast was based on my observations about a two-tier market environment that still feels reminiscent of the late 1990s Tech Bubble. In the same way that over-reactions to negative news may create opportunities for value investors, extrapolation of the rapid growth of new technologies may lead to excessively high prices for the stocks of the new “disruptive” companies that are driving change. As dreams give way to economic realities, bifurcated markets may return to equilibrium with relatively strong gains for those who avoided the hype. As you can see below, Value stocks performed relatively well in the aftermath of the 1997-99 Tech Bubble. Likewise, over the last two years, Value stocks have begun to recoup the relative under-performance they suffered during the FAANG stock love affair from 2017-20. Interestingly, the ’17-‘20 outperformance of Growth stocks lasted longer (four years versus three) and the performance differential was even more extreme than what we saw during the Tech Bubble. If past is prologue, Value stocks might produce a couple more years of outsized returns.

|

Compound Annual Returns |

1997-99 | 2000-02 | 2003-16 | 2017-20 | 2021-22 |

| Russell 1000 Value Index | +18.8% | -5.1% | +9.3% | +7.9% | +7.6% |

| Russell 1000 Growth Index | +34.1% | -23.6% | +9.4% | +24.8% | -4.9% |

| Value versus Growth | -15.3% | +18.5% | -16.9% | +12.5% |

Source: Poplar Forest Capital; dates are for full years (January 1st through December 31st)

As you can also see in the chart above, outside of these extreme Growth and Value cycles, the returns of Growth and Value stocks, as measured by Russell’s indices, were almost identical in the 14 years from 2003 through 2016. Investing wasn’t about choosing between Growth or Value; success depended on selecting stocks with idiosyncratic characteristics that could deliver solid returns in a more stylistically-agnostic market. That is exactly what we strive to do at Poplar Forest.

Value Investing is Hard – Maybe That’s Why it Works

“It’s something cold like what I stuck around to fight through

And it gets feeling tougher every day…

And if you’d listen in, tomorrow could be better than it seems”

Billy Strings, Secrets, from his 2021 album Renewal

I’ve sometimes half-jokingly said that I failed peer pressure in high school. I had a couple of great friends, but I was never in the cool kid clique. To be “in,” you were supposed to dress and behave a certain way and listen to the “right” bands. I’ve always had strong opinions about how I want to do things and I wasn’t willing to change just to be popular. Standing apart from the crowd makes a lot of people nervous. I believe there is something in the evolutionary DNA of humans that tells us there is safety in numbers. Being part of the herd may reduce the odds of being eaten by a lion, but I believe the blue grass is sweeter when it hasn’t been trampled on by a bunch of hooves. Likewise, I believe there are bargains to be found among the stocks that have been shunned by the crowd.

Value investing isn’t simply about buying cheap stocks; success depends on identifying those that are undeservedly inexpensive. In the short term, a company’s business fundamentals may look terrible, but if after careful analysis those challenges appear to only be temporary, there may be opportunity. That said, it sometimes takes years for an individual company’s virtues to be recognized and the wait for improvement can be lonely. The successful Value investor needs both patience and confidence – the ability to feel comfortable stepping in when conditions are uncertain and other investors are fearful of loss. Doing that is hard, and perhaps that’s why contrarian value investing works.

Think back to early 2020 – the price of oil had collapsed and had even gone negative for a short period of time. Oil companies were losing money, banks cut back on lending to the industry, and some investors were shunning the stocks over environmental concerns. A group of stocks that had been the largest sector in the market in 1980 had become one of the smallest, at just 2.6% of the S&P by March 31, 2020. If that’s not a description of unloved and out-of-favor, I don’t know what is.

But a funny thing happened: all that negativity reversed and, over the last three years, energy stocks have generated returns that have left other market sectors in the dust. During that period, the stocks we owned in the energy sector collectively provided the second highest contribution to our results (after financials). Was it difficult to step into what looked to others like an abyss? Yes. Was it worth it? Absolutely!

Experience is a Great Teacher

“Well I thought I knew it all, till I crashed into the wall

Let me learn from my mistakes and try to pick up all the pieces”

Billy Strings, Know It All, from his 2021 album Renewal

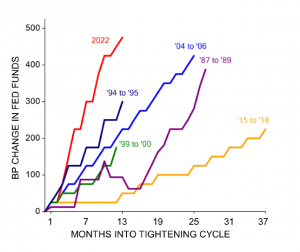

In recent weeks, financial stocks have moved into the realm of the unloved and out-of-favor. Years of low interest rates and abundant liquidity were like a tide that lifted all boats, but as Warren Buffett famously said, “You only find out who was swimming naked when the tide goes out.” For roughly a year now, the Fed has been aggressively raising interest rates to combat inflation, yet certain banks – including, as we all now know, Silicon Valley Bank – continued to hold portfolios of long-term bonds that typically fall when interest rates rise. When their depositors realized that the price declines in the banks’ securities portfolios could potentially wipe out the banks’ equity, they wanted to get their deposits back and that ultimately led to the banks’ demise. Banks whose results worked well in the low-rate era that followed the Global Financial Crisis (the “GFC”) in 2008-09, found that their business models were less robust as the Fed raised rates at an historically rapid pace.

Source: Standard $ Poor’s/ Capital IQ

They say history doesn’t repeat, but that it often rhymes. In the run-up to the GFC, the Fed’s post-Tech-Bubble easy-money policies inflated the housing bubble. The Fed started raising rates in the summer of 2004, and by early July 2006, the Yield Curve had inverted with short-term interest rates higher than those of 10-year Treasury bonds. Trouble was not long in coming. The FDIC’s recent seizure of Silicon Valley Bank and Signature Bank and the forced sale of Credit Suisse to UBS reminded me of the 2008 FDIC seizures of IndyMac and Washington Mutual, and the takeovers of Countrywide and Merrill Lynch by Bank of America. And perhaps no market cycle can be complete without a scandal. In 2008, it was Madoff; this time we’ve seen former Crypto-King Sam Bankman-Fried unmasked as a fraud. So far, the overall stock market, as measured by the S&P 500, has remained remarkably resilient, all these things considered.

I worry that we’ve only seen the first shoe to drop: the impact of higher interest rates on the price of financial assets. The current banking crisis is likely to result in tighter credit standards which may result in reduced loan availability, slower economic growth, and lower corporate earnings. The continued inversion of the yield curve suggests we’ll have to live through a recession in the next 12 months, but with the S&P 500 valued at more than 18x earnings, investors seem to believe that it is different this time – that somehow the Fed will be able to whip inflation without any real economic pain. I think that mindset may be misguided. While we will only know in hindsight if the low reached last October (a 25% decline) was the bottom, I believe it is prudent to plan for a challenging market environment at least until the Fed has stopped raising interest rates.

At Poplar Forest, we have been building a recession into our financial forecasts for almost a year now. I believe that means our portfolio is relatively well positioned for the coming economic slowdown we foresee. Importantly, none of our funds were invested in any of the troubled banks that have been seized by regulators and we believe that our financial service company investments may emerge as winners in the current environment. For example, our two biggest bank investments, Wells Fargo and Citigroup, are well capitalized, closely regulated, and we believe their financial strength may allow them to take market share during the current bank industry turmoil.

The Outlook – Volatility May Bring Opportunity

“Stay on track. Don’t let me see you lookin’ back”

Billy Strings, Must Be Seven, from his 2021 album Home

The start of the year saw many of last year’s losers become this year’s winners. Psychologically, investors are often drawn to past winners because of the success they had with those stocks, but, in my opinion, that could be a mistake. The investment playbook that worked well in the post-GFC period, may not work as well going forward. For the last fifteen years, monetary policy was aimed at stimulating economic growth by keeping short-term interest rates below the rate of inflation. This kept a lid on companies’ cost of capital and cheap funding has been fuel for the growth of the “innovation economy.”

With inflation having reared its head and the Fed responding aggressively, I believe the easy-money-backed Growth stock market may have seen its best days. While some investors may continue to buy the dips in the last cycle’s winners, I think they may be setting themselves up for disappointment given current valuations, increasing competition in many Growth industries, and a Fed that seems hell-bent on returning inflation to 2%. In this environment, using the rearview mirror as an investment tool could leave your pickup truck stuck in the ditch with a broken axle. As investors who don’t look back, but forward, we believe our investment process may be particularly fruitful in the new environment that seems likely to include structurally higher real interest rates.

Given our disciplined investment process, it may come as no surprise that, early in the recent quarter, we trimmed a few positions that had done well as the stock market rallied 16% from last October’s low to a February high. During this time, we also eliminated our investment in Curtis Wright. We invested in Curtis Wright in late 2020 when the stock was being pessimistically valued at just 12x earnings. Given our outlook for 10-11% earnings growth, the stock looked like a bargain. In the intervening years, earnings have come through as we expected and the valuation expanded to more than 20x earnings – a level that we believe reflects a lot of optimism about the future.

Some of the proceeds from the sale of Curtis Wright were used to make an initial investment in a food company whose margins appear depressed. Our research suggests a bright future, even though the valuation of the company’s stock suggests to us a great deal of investor skepticism regarding profitability improvement. Furthermore, if aggressive Fed action pushes the economy into recession, food companies may hold up better than the broad market.

As a result of those trades, our cash reserve increased to roughly 5% of assets and I’m glad to have some buying power given the Fed’s aggressive battle against stubbornly high inflation. If investors again grow fearful of recession risk, as they did last fall, we may be presented with some very compelling investment opportunities.

As it stands now, I feel great about the companies in which we are invested and believe they have more than ample financial strength to manage a coming recession. I also believe we have a compelling margin of safety given the portfolio’s valuation of less than 11x expected earnings. The portfolio also sports a greater than 6% free cash yield (last 12 months’ cash from operations less capital spending, divided by current market value) and our forecasts suggest double digit annual growth in free cash flow over the next 3-4 years. In addition, we have identified a half dozen companies that have been thoroughly researched by our investment team, whose analysis suggests the stocks appear to offer compelling long-term value. These companies are generally more economically-sensitive than average and we are ready to pounce if short-term recessionary worries drive their stock prices down to levels that we believe may offer exceptional risk-adjusted, long-term returns.

At Poplar Forest, we aren’t singing the blues, quite the contrary. We have a philosophy and process that have worked well over time, and the members of our band know how to make our portfolio sing. We stayed true to our process during investors’ love affair with FAANG stocks, and we are sticking with it now during the current banking crisis that has sent investors running away from financial service companies and back to mega-cap tech stocks. While some investors may be living in fear of a GFC replay, I have tremendous confidence in the financial strength of the companies in which we are invested.

In summary, I love the stocks we own today and I’m excited about the opportunities that may be coming our way. And in the same way that Billy Strings needs a band to turn the songs he writes into wonderful music, I couldn’t do what I do without help. I would like to offer my sincere thanks to our outstanding Poplar Forest team and to our wonderful clients on whose behalf we work every day.

Sincerely,

March 31, 2023

P.S. While I realize that not everyone shares my love for bluegrass music, if you want to explore the genre, I suggest the following songs (my favorites) as a starting place:

By Billy Strings: Secrets

John Deere Tractor

This Old World

By The Steeledrivers: Heaven Sent

Blue Side Of The Mountain

If It Hadn’t Been For Love

Standardized Performance and Top Ten Holdings: Partners Fund, Cornerstone Fund

Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling 877-522-8860.

Opinions expressed are subject to change at any time, are not guaranteed and should not be considered investment advice. Holdings and allocations are subject to change at any time and should not be considered a recommendation to buy or sell any security. Index performance is not indicative of a fund’s performance. Value stocks typically are less volatile than growth stocks; however, value stocks have a lower expected growth rate in earnings and sales.