Questions of Value — A New Market Regime?

Questions of Value is a series of memos in which we address common questions from our clients about the Partners Fund and Value investing. We welcome your feedback and suggestions for future memos.

The investment backdrop has significantly changed due to record levels of inflation, rising interest rates, a war in Eastern Europe, and unprecedented disruptions to global supply chains. Inflation readings above 5% and a war in Ukraine are the types of developments that most market participants have only read about, but never actually experienced, in their professional lifetimes. Asset classes and investment strategies that worked well in prior years are faltering in 2022 and intra-day volatility is rising.

Many of our clients have had great success over the last five to ten years with their asset allocation decisions but, following such a jarring start to 2022, are now expressing varying degrees of concern and uncertainty regarding how best to position portfolios for this new capital markets landscape. Market history suggests that most investment themes eventually reverse due to some combination of overly optimistic valuations, financial leverage, and macroeconomic surprises. These reversal periods can be prolonged by well documented cognitive biases that serve to inhibit an investor’s ability to quickly adapt to changes in the environment–particularly when those changes are in conflict with what has worked well in prior years.

In this memo, we share our thinking on some of the implications of this new market regime and highlight which changes may be transitory and which may persist beyond 2022. We also delve into research on human psychology that suggests there could be a protracted transition period from the strategies that worked well over the last 10 years to those better positioned for these new capital market dynamics.

The implications of inflation and rising interest rates

While we aren’t top down investors, it is often necessary to evaluate macroeconomic factors when considering different future scenarios for our portfolio companies. The 20 year highs being recorded for inflation have caused concern at the Federal Reserve and led Chairman Powell to signal that significant rate increases are coming in 2022. Slowing economic growth in Europe and China combined with weakening price trends for various commodities suggests near-term inflation trends may soften relative to the 8%+ consumer price index (CPI) reading in March. Unfortunately, however, there are also plenty of reasons to think that inflation above 2% may persist beyond 2022. Two reasons to think above average rates of inflation will endure are: (1) historical underinvestment in new supplies of essential commodities; and (2) record low unemployment rates in the United States.

As the economist Greg Ip noted in the Wall Street Journal on April 27, 2022, “Inflation is the result of demand growing faster than supply. Central banks can deal with the demand part. The problem is that the world they confront in coming years might be one of recurrent supply shocks.” Supplies for oil and other essential commodities were already tight prior to the war in Ukraine and, with supplies from Russia and Ukraine now restricted or impaired, global demand is exceeding available supply. While we believe high prices will stimulate investments in new supply, the reality is that developing a major new oil field or greenfield mine for potash, copper, or lithium takes years, not months. If you are trying to develop these resources in the United States, timelines are prolonged by regulatory barriers, dilapidated infrastructure, and bidding wars for skilled labor. Tight labor markets and rising prices for food, gas, and household products have led many workers in the United States to demand higher pay. The persistence and magnitude of this budding wage-price spiral bears monitoring.

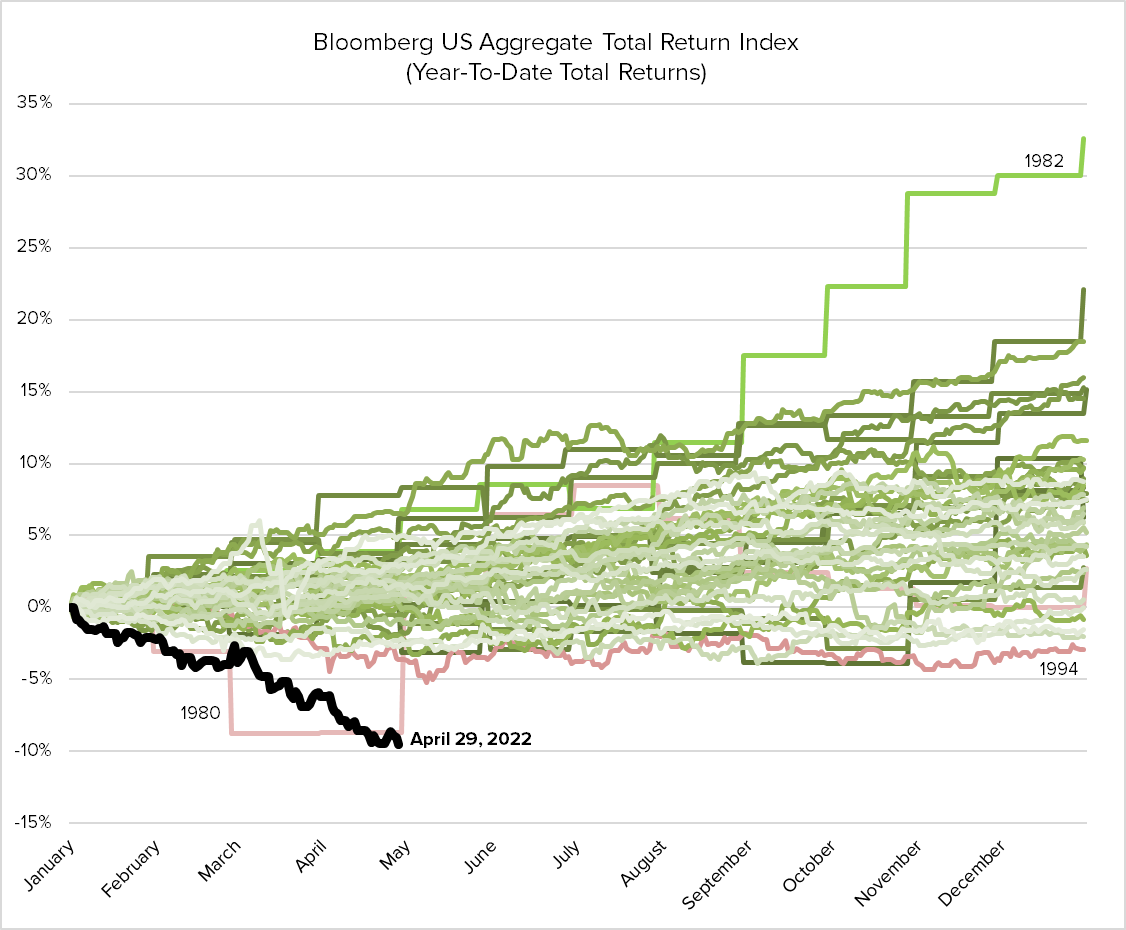

As the chart below highlights, uptrends in inflation and interest rates may finally be signaling the end of the 40 year bull market in bonds. We find it significant that many indices tracking fixed income returns are registering the worst year-to-date performance trends since the 1980’s. Within equity markets, rising interest rates suggest that valuation multiples for many fast growing or speculative businesses could decline, perhaps significantly. The prior equity market trend of rising valuation multiples during an era of flat-to-falling interest rates may be reversing.

Fixed income returns haven’t been this bad since 1980:

For our portfolios, a conservative approach to valuation multiples has long been our North Star. We continue to emphasize balance when thinking through the potential impacts of inflation and rising interest rates on portfolio construction. On the one hand, we estimate approximately 38% of our portfolio companies across the energy, materials, and financial services industries will benefit from rising inflation and interest rates. On the other hand, we are mindful that rate increases, the withdrawal of fiscal stimulus, and adverse geopolitical developments may dampen economic growth. We have maintained a healthy mix of more defensive businesses across the healthcare and consumer staples sectors which together comprise 30% of our portfolio. We believe these investments may mitigate the portfolio impact of any potential economic weakness.

Across our portfolios, we apply a strict valuation discipline that emphasizes absolute returns, not relative returns. Many investment strategies have anchored their valuation frameworks to market multiples and benefitted from a consistent valuation tailwind as multiples expanded over the last 10 years. These same relative value strategies may struggle in coming years if the S&P 500 P/E multiple declines from 18x forward earnings to the mid-teens range associated with higher interest rate environments, such as the 2000’s. For context, the Partners Strategy current forward P/E multiple is 11x. We expect our portfolio companies to generate high single digit earnings growth and an aggregate 2% dividend yield which equates to a double digit fundamental return. Company specific self-help opportunities and low absolute valuations are the primary themes uniting our diverse and balanced collection of companies.

It can be hard to change after you’ve been right

After years of attractive returns, rapidly changing fact patterns create significant challenges for capital allocators in 2022. Bonds look broadly unattractive in the context of rising rates, and many top fixed income investors now acknowledge this point. Some of our clients are choosing to increase their allocations to cash but, in the face of rising inflation, cash risks a loss of purchasing power. Investments in real assets and private equity may offer favorable risk vs. reward profiles compared to fixed income but come with high fees, limited access to alpha generating managers, and liquidity concerns.

Active, value oriented equity strategies with a focus on absolute returns may be worthy of greater attention in this new market regime. Favorable results during this period of market turbulence have renewed client interest in strategies like ours but we still sense significant hesitation. After reflecting on some recent client conversations, we think that many asset allocators, particularly those who have been successful during the prior market regime, are finding it hard to change after having been right for so long. Research into human psychology and behavioral finance offers some insights into why change can be hard when it follows years of success.

Two well documented cognitive inhibitors to change are the confirmation and status quo biases. Confirmation bias has been observed throughout human history and discussed by a variety of figures including the Greek historian Thucydides, the Italian poet Dante, and the English philosopher Francis Bacon. Starting in the 1960’s, social scientists and psychologists began to more precisely document the strong tendency of people to search for and overweight evidence that confirms prior beliefs and underweight or ignore evidence that contradicts these beliefs. While there is some debate as to why a confirmation bias exists, a reasonable explanation may be that it simplified and accelerated decision making. During much of our evolutionary history, the ability to make quick decisions based on instinct or rules of thumb passed down over generations could often mean the difference between life and death. Reinforcing the confirmation bias is the status quo bias which can be thought of as the tendency of human beings to avoid change. The status quo bias may have emerged as a useful trait since it facilitated group cooperation which is an essential strategy for our species’ survival. After all, it would be impossible for our ancestors to work effectively as a team if everyone was constantly changing their minds.

The confirmation and status quo biases have value and certainly serve to simplify decision making and group coordination in a complex world. Unfortunately, they can also impede our ability to adapt to new environments and changing fact patterns. If we are correct in our observation that a new market regime has begun, then the confirmation and status quo biases suggest it could take years, not months, for most market participants to adapt.

Let’s Discuss — We’d Love To Hear From You

Please contact Drew Taylor (dtaylor@poplarforestllc.com or (626) 304-6030) or your Poplar Forest relationship manager with feedback and suggestions for future Insights. Follow us on LinkedIn where we commonly post useful and informative material.

Standardized Performance and Top Ten Holdings: Partners Fund, Cornerstone Fund

Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling 877-522-8860.

Opinions expressed are subject to change at any time, are not guaranteed and should not be considered investment advice. Holdings and allocations are subject to change at any time and should not be considered a recommendation to buy or sell any security. Index performance is not indicative of a fund’s performance. Value stocks typically are less volatile than growth stocks; however, value stocks have a lower expected growth rate in earnings and sales.